SEC Proposes Changes to Shareholder Rule that Would Restrain Shareholder Advocacy for an Equitable Economy

The Vision of Investor Advocates for Social Justice (IASJ) is to realize an equitable economy where investors leverage their collective voice and resources to advance social, economic, and environmental justice. One of our strategies for achieving this equitable economy is the shareholder proposal process, which allows shareholders, based on research and consultation with community stakeholders, to introduce timely issues to the broader investor community and company management in order to prompt reflection, consideration, and, if deemed necessary, additional disclosure or action. For decades, IASJ and other investors have used this tool, alongside dialogues, to encourage corporate management to act on important and emerging environmental, social, and governance issues.

On November 5, the Securities and Exchange Commission (SEC) voted in favor of proposed changes to its shareholder proposal rule that would make it more difficult for investors to participate in the corporate proxy. This proposed rulemaking puts constraints on the opportunity of our Affiliates and other investors to advocate for this envisioned economy that works for all people and promotes long term value for shareholders. IASJ is committed to active ownership and shareholder advocacy, conducting dialogues with over 50 companies each year, and filing hundreds of shareholder resolutions throughout our history. This tool has initiated dozens of constructive dialogues with corporate leadership over the years and led to serious commitments to address urgent issues of concern to stakeholders and society- such as climate disclosure, environmental pollution, GMOs, responsible financial practices, water stewardship, and forced labor. Reflection on our history of advocacy shows that many of these corporate practices that are now identified as in the best interest of society and our economy were at one point seen as novel, outside the scope of relevant issues for shareholder consideration, and were not widely supported by the investor community. For example, IASJ and other investors filed repeated shareholder resolutions over the span of two decades with banks, oil & gas producers, technology companies, and other consumer goods businesses to withdraw their business from South Africa until apartheid was abolished. This extensive effort was one of many factors and movements that contributed to ending Apartheid. We must be informed by this history and ensure the rules that govern investors and corporations allow space for innovation, voices of the minority, and societal progress that requires persistence.

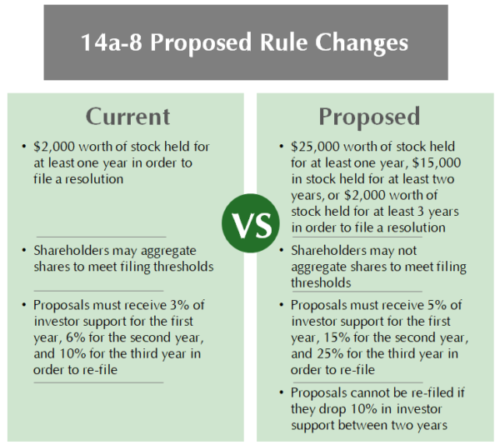

Currently, the SEC’s 14a-8  shareholder rule requires investors to own $2,000 worth of stock in a company for at least one year in order to file a resolution. This amount is reasonable and appropriate and allows all investors, large and small, to have access to this important process. In contrast, the proposed rule attempts to make it significantly more difficult to file a resolution, requiring higher levels of ownership when stock is held for a shorter period of time. Specifically, the proposed changes would require a filer who has held shares in a company for one year to have $25,000 in stock, $15,000 in stock if held for at least two years, or $2,000 in stock, if it has been held for at least three years. Investors will no longer be able to aggregate shares to meet these thresholds. This risks excluding small investors and may impact our community of faith-based shareholders who have pioneered proposals on important emerging issues. This serves to tilt the balance of power and access in favor of larger investors. The extended holding period may restrict an investor’s ability to make investment decisions based on their own identified criteria, strategies or priorities. For decades, small and faith-based investors have filed resolutions on compelling topics like climate change, public health crises, and civil conflict.

shareholder rule requires investors to own $2,000 worth of stock in a company for at least one year in order to file a resolution. This amount is reasonable and appropriate and allows all investors, large and small, to have access to this important process. In contrast, the proposed rule attempts to make it significantly more difficult to file a resolution, requiring higher levels of ownership when stock is held for a shorter period of time. Specifically, the proposed changes would require a filer who has held shares in a company for one year to have $25,000 in stock, $15,000 in stock if held for at least two years, or $2,000 in stock, if it has been held for at least three years. Investors will no longer be able to aggregate shares to meet these thresholds. This risks excluding small investors and may impact our community of faith-based shareholders who have pioneered proposals on important emerging issues. This serves to tilt the balance of power and access in favor of larger investors. The extended holding period may restrict an investor’s ability to make investment decisions based on their own identified criteria, strategies or priorities. For decades, small and faith-based investors have filed resolutions on compelling topics like climate change, public health crises, and civil conflict.

Furthermore, the rule proposes to change how recurring resolutions will be handled, setting a higher threshold of investor support for a resolution to be reintroduced. The current shareholder rule mandates that in order to re-file, proposals must receive 3% of investor support for the first year, 6% for the second year, and 10% for the third year. The new proposed thresholds have escalated to 5%, 15%, and 25% respectively. This would serve to stifle new ideas and emerging issues, which often take time to gain traction as investors become more familiar with the issues presented, including some of the proposals filed by Affiliates of Investor Advocates for Social Justice. The new rule would also punish resolutions that lose traction, rendering them unable to re-file if they drop 10% in investor support between two years. If enacted, these proposed re-filing rules would exclude resolutions that have been receiving widespread investor support on topics like political lobbying activity, climate change, election spending, and workplace diversity.

The proposed rulemaking contradicts the SEC’s mandate to protect investors, promote fairness in the securities markets, and encourage corporate transparency and disclosure. Many shareholders argue that the current rule is effective, transparent, and efficient, and the changes – initiated by corporations – aim to protect corporate management from public scrutiny or pressure to take more meaningful action on environmental, social, and governance issues that threaten those who are most vulnerable in our economy. The proposed changes will be submitted to a public 60-day comment period, which ends on February 3, 2020. To submit comments, use the SEC’s Internet submission form or send an email to rule-comments@sec.gov.

The Shareholder Rights Group will continue to gather and post information on the proposed rulemaking on 14a8 – https://www.investorrightsforum.com/new-blog-1/investor-statements-regarding-sec-proposed-rulemaking